The information that follows should serve as a guide for understanding and calculating Indirect Cost (IDC) Recovery (also commonly referred to as F&A or Facilities & Administrative costs) as a part of the proposed budget. Please note: these guidelines apply to all Western SARE grant opportunities (Research & Education; Sabbatical; Professional + Producer; Graduate Student; Professional Development Program; Local Education and Demonstration; and, State Implementation) with the exception of Farmer and Rancher Grants (all funds go directly to the producer; therefore, IDC recovery is not allowed).

USDA NIFA may apply legislative limits on IDC recovery for its various programs. Under the SARE program and for projects funded in 2022 or later, NIFA states IDCs may not exceed 10% of the Total Direct Costs (TDC) requested. Note: the 10% TDC limit is a cap on the portion of an applicant’s budget that may be requested for IDCs; it is not an IDC rate.

When applying for a Western SARE grant, please be aware there are a few IDC recovery scenarios. Only one scenario will apply to the applicant and is dependent upon whether the applicant entity has a Federally Negotiated Indirect Cost Rate Agreement (NICRA).

Entity Applicants with a NICRA:

For entities that have a NICRA, IDCs MUST be calculated at a rate of 10% of Total Direct Costs (TDC). This is the maximum indirect cost recovery (IDC cap) allowed under the SARE program per USDA/NIFA. The 10% TDC IDC cap should be applied consistently to both the primary applicant and any proposed lower-tier subrecipients; therefore, include the total costs of any/all proposed lower-tier subawards in the IDC recovery base.

Rarely, an entity may have a lower (than 10% TDC) NICRA. If this is the case, please provide clarification in the budget justification. When filling out the Western SARE Budget Workbook, enter the approved rate in the third IDC option field and enter the applicable IDC base to make the calculation. A copy of the NICRA will be requested should the proposal be selected for funding.

Non-Federal Entity Applicants without a NICRA:

Per Federal Uniform Guidance, non-Federal entities that have never had a NICRA, or previously had a NICRA but it is no longer in effect, may claim the de minimis rate. Note: the de minimis rate has increased to up to 15% of Modified Total Direct Costs (MTDC). MTDC includes all direct costs (salaries/benefits, supplies, services, communications, travel) except for the following: the amount of each lower-tier subaward that exceeds $50,000 (over the entire project period), participant/trainee support costs, tuition remission (only allowed on Research & Education projects), and capital expenditures (rent, equipment).

Alternatively, an entity without a NICRA that has not claimed the de minimis on prior Federal awards may decline IDC recovery entirely.

To learn more about the de minimis rate, please visit part 200.414 of the Electronic Code of Federal Regulations.

When selecting a de minimis rate, it is important to note that IDCs may not exceed the USDA NIFA IDC recovery limit on SARE awards. If awarded, all budgets using a de minimis rate will be reviewed to ensure this; a re-budget will be requested, if needed.

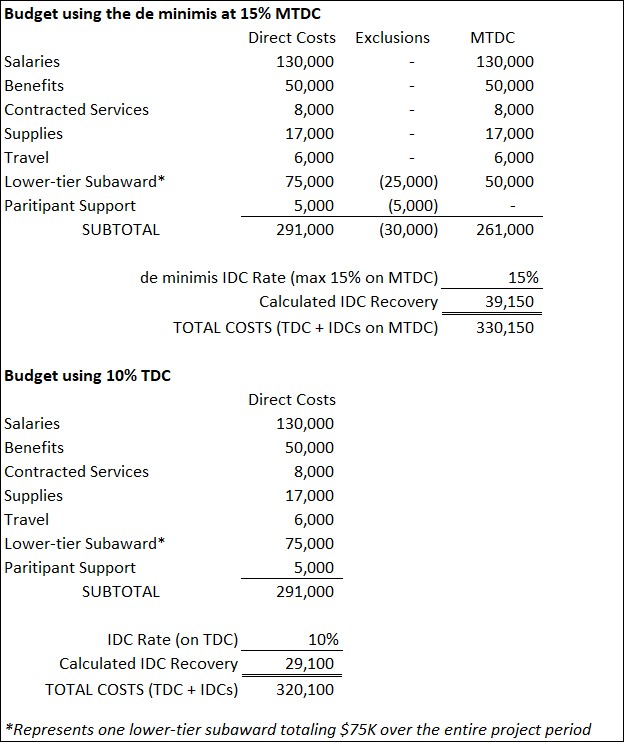

The following example demonstrates how to compare a budget with a de minimis rate to a budget with the USDA NIFA cap of 10% TDC. For this example, the CFP states applicants may request up to $350,000 total costs. The PI’s organization does not have a NICRA and wishes to request the max de minimis rate of 15% on MTDC.

In the above example, if the applicant entity does not have a NICRA and is using the max de minimis rate of 15% MTDC, the applicant would need to revert to using 10% TDC for IDC recovery as using the 15% de minimis exceeds 10% of Total Direct Costs, the IDC recovery cap.

Acronyms

CFP Call for Proposals

IDCs Indirect Costs* (also known as F&A – Facilities & Administrative Costs)

MTDC Modified Total Direct Costs*

NICRA (Federally) Negotiated Indirect Cost Rate Agreement

TDC Total Direct Costs

*These and many other terms are defined in part 200.1 of the Electronic Code of Federal Regulations.